This is an opinion editorial by Taimur Ahmad, a graduate student at Stanford University, focusing on energy, environmental policy and international politics.

Author’s note: This is the first part of a three-part publication.

Part 1 introduces the Bitcoin standard and assesses Bitcoin as an inflation hedge, going deeper into the concept of inflation.

Part 2 focuses on the current fiat system, how money is created, what the money supply is and begins to comment on bitcoin as money.

Part 3 delves into the history of money, its relationship to state and society, inflation in the Global South, the progressive case for/against Bitcoin as money and alternative use-cases.

Bitcoin As Money: Progressivism, Neoclassical Economics, And Alternatives Part II

*The following is a direct continuation of a list from the previous piece in this series.

3. Money, Money Supply And Banking

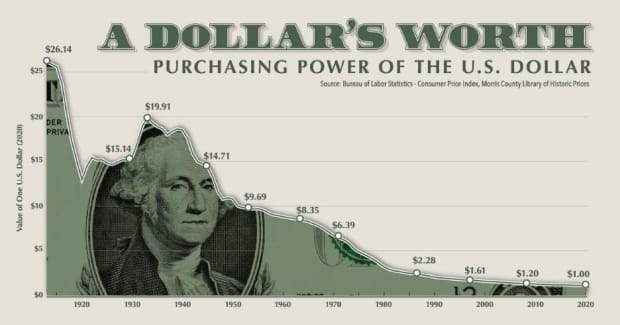

Now onto the third point that gets everybody riled up on Twitter: What is money, what is money printing and what is the money supply? Let me start by saying that the first argument that made me critical of the political economy of Bitcoin-as-money was the infamous, sacrilegious chart that shows that the U.S. dollar has lost 99% of its value over time. Most Bitcoiners, including Michael Saylor and co., love to share this as the bedrock of the argument for bitcoin as money. Money supply goes up, value of the dollar comes down — currency debasement at the hands of the government, as the story goes.

Source: Visual Capitalist

I have already explained in Part 1 what I think about the relationship between money supply and prices, but here I’d like to go one level deeper.

Let’s start with what money is. It is a claim on real resources. Despite the intense, contested debates across historians, anthropologists, economists, ecologists, philosophers, etc., about what counts as money or its dynamics, I think it is reasonable to assume that the underlying claim across the board is that it is a thing that allows the holder to procure goods and services.

With this backdrop then, it doesn’t make sense to look at an isolated value of money. Really though, how can someone show the value of money in and of itself (e.g., the value of the dollar is down 99%)? Its value is only relative to something, either other currencies or the amount of goods and services that can be procured. Therefore, the fatalistic chart showing the debasement of fiat doesn’t say anything. What matters is the purchasing power of consumers using that fiat currency, as wages and other social relations denominated in fiat currency also move synchronously. Are U.S. consumers able to purchase 99% less with their wages? Of course not.

The counterarguments to this typically are that wages don’t keep up with inflation and that over the short-medium term, cash savings lose value which hurts the working class as it doesn’t have access to high yielding investments. Real wages in the U.S. have been constant since the early 1970s, which in and of itself is a major socioeconomic problem. But there is no direct causal link between the expansionary nature of fiat and this wage trend. In fact, the 1970s were the start of the neoliberal regime under which labor power was crushed, economies were deregulated in favor of capital and industrial jobs were outsourced to underpaid and exploited workers in the Global South. But I digress.

Let’s go back to the what is money question. Apart from a claim over resources, is money also a store of value over the medium term? Again, I want to be clear that I am talking only about developed nations thus far, where hyperinflation isn’t a real thing so purchasing power doesn’t erode overnight. I’d argue that it is not the role of money — cash and its equivalents like bank deposits — to serve as a store of value over the medium-long term. It is supposed to serve as a medium of exchange which requires price stability only in the short run, coupled with gradual and expected devaluation over time. Combining both features — a highly liquid, exchangeable asset and a long-term savings mechanism — into one thing makes money a complicated, and maybe even contradictory, concept.

To protect purchasing power, access to financial services needs to be expanded so that people have access to relatively safe assets that keep up with inflation. Concentration of the financial sector into a handful of large players driven by profit motive alone is a major impediment to this. There is no inherent reason that an inflationary fiat currency has to lead to a loss of purchasing power time, especially when, as argued in Part 1, price changes can happen because of multiple non-monetary reasons. Our socioeconomic setup, by which I mean the power of labor to negotiate wages, what happens to profit, etc., needs to enable purchasing power to rise. Let’s not forget that in the post-WWII era this was being achieved even though money supply was not growing (officially the U.S. was under the gold standard but we know it was not being enforced, which led to Nixon moving away from the system in 1971).

Okay so where does money come from and were 40% of dollars printed during the 2020 government stimulus, as is commonly claimed?

Neoclassical economics, which the Bitcoin standard narrative employs at various levels, argues that the government either borrows money by selling debt, or that it prints money. Banks lend money based on deposits by their clients (savers), with fractional reserve banking allowing banks to lend multiples higher than what is deposited. It comes as no surprise to anyone who is still reading that I’d argue both these concepts are wrong.

Here’s the correct story which (trigger warning again) is MMT based — credit where it’s due — but agreed to by bond investors and financial market experts, even if they disagree on the implications. The government has a monopoly on money creation through its position as the sovereign. It creates the national currency, imposes taxes and fines in it and uses its political authority to protect against counterfeit.

There are two distinct ways in which The State interacts with the monetary system: one, through the central bank, it provides liquidity to the banking system. The central bank does not “print money” as we colloquially understand it, rather it creates bank reserves, a special form of money that isn’t really money that is used to buy goods and services in the real economy. These are assets for commercial banks that are used for inter-bank operations.

Quantitative easing (those scary big numbers that the central bank announces it is injecting by buying bonds) is categorically not money printing, but simply central banks swapping interest bearing bonds with bank reserves, a net neutral transaction as far as the money supply is concerned even though the central bank balance sheet expands. It does have an impact on asset prices through various indirect mechanisms, but I won’t go into the details here and will let this great thread by Alfonso Peccatiello (@MacroAlf on Twitter) explain.

So the next time you hear about the Fed “printing trillions” or expanding its balance sheet by X trillion, just think about whether you are actually talking about reserves, which again don’t enter the real economy so do not contribute to “more money chasing the same amount of goods” story, or actual money in circulation.

Two, the government can also, through the Treasury, or its equivalent, create money (normal people money) that is distributed through the government’s bank – the central bank. The modus operandi for this operation is typically as follows:

- Say the government decides to send a one-time cash transfer to all citizens.

- The Treasury authorizes that payment and tasks the central bank to execute it.

- The central bank marks up the account that each commercial bank has at the central bank (all digital, just numbers on a screen — these are reserves being created).

- the commercial banks correspondingly mark up the accounts of their customers (this is money being created).

- customers/citizens get more money to spend/save.

This type of government spending (fiscal policy) directly injects money into the economy and is thus distinct from monetary policy. Direct cash transfers, unemployment benefits, payments to vendors, etc., are examples of fiscal spending.

Most of what we call money, however, is created by commercial banks directly. Banks are licensed agents of The State, to which The State has extended its powers of money creation, and they create money out of thin air, unconstrained by reserves, every time a loan is made. Such is the magic of double-entry bookkeeping, a practice that has been in use for centuries, where money comes into being as a liability for the issuer and an asset for the receiver, netting out to zero. And to reiterate, banks don’t need a certain amount of deposits to make these loans. Loans are made subject to whether the bank thinks it makes economic sense to do so — if it needs reserves to meet regulations, it simply borrows them from the central bank. There are capital, not reserve, constraints on lending but those are beyond the scope of this piece. The primary consideration for banks in making loans/creating money is profit maximization, not whether it has enough deposits in its vault. In fact, banks are creating deposits by making loans.

This is a pivotal shift in the story. My analogy for this is parents (neoclassical economists) telling children a fake birds and bees story in response to the question of where babies come from. Instead, they never correct it leading to an adult citizenry running around without knowing about reproduction. This is why most people still talk about fractional reserve banking or there being some naturally fixed supply of money that the private and public sectors compete over, because that’s what econ 101 teaches us.

Let’s revisit the concept of money supply now. Given that most of the money in circulation comes from the banking sector, and that this money creation is not constrained by deposits, it is reasonable to claim that the stock of money in the economy is not just driven by supply, but by demand as well. If businesses and individuals are not demanding new loans, banks are unable to create new money. This has a symbiotic relationship with the business cycle, as money creation is driven by expectations and market outlook but also drives investment and expansion of output.

The chart below shows a measure of bank lending compared to M2. While the two have a positive correlation, it does not always hold, as is glaringly evident in 2020. So even though M2 was surging higher post-pandemic, banks were not lending due to uncertain economic conditions. As far as inflation is concerned, there is the added complexity of what banks are lending for, i.e., whether those loans are being used for productive ends, which would increase economic output or unproductive ends, which would end up leading to (asset) inflation. This decision is not driven by the government, but by the private sector.

The last complication to add here is that while the above metrics serve as useful measures for what happens within the US economy, they do not capture the money creation that happens in the eurodollar market (eurodollars have nothing to do with the euro, they simply refer to the existence of USD outside the U.S. economy).

Jeff Snider gave an excellent run through of this during his appearance on the What Bitcoin Did podcast for anyone who wants a deep-dive, but essentially this is a network of financial institutions that operate outside the U.S., are not under the formal jurisdiction of any regulatory authority and have the license to create U.S. dollars in foreign markets.

This is because the USD is the reserve currency and required for international trade between two parties that may not have anything to do with the U.S. even. For example, a French bank may issue a loan denominated in U.S. dollars to a Korean company wanting to buy copper from a Chilean miner. The amount of money created in this market is anyone’s guess and hence, a true measure of the money supply is not even feasible.

This is what Alan Greenspan had to say in a 2000 FOMC meeting:

“The problem is that we cannot extract from our statistical database what is true money conceptually, either in the transactions mode or the store-of-value mode.”

Here he refers not just to the Eurodollar system but also the proliferation of complex financial products that occupy the shadow banking system. It’s hard to talk about money supply when it’s hard to even define money, given the prevalence of money-like substitutes.

Therefore, the argument that government intervention through fiscal and monetary expansion drives inflation is simply not true as most of the money in circulation is outside the direct control of the government. Could the government overheat the economy through overspending? Sure. But that is not some predefined relationship and is subject to the state of the economy, expectations, etc.

The notion that the government is printing trillions of dollars and debasing its currency is, to no one’s surprise at this point, just not true. Only looking at monetary intervention by the government presents an incomplete picture as that injection of liquidity could be, and in many cases is, making up for the loss of liquidity in the shadow banking sector. Inflation is a complex topic, driven by consumer expectations, corporate pricing power, money in circulation, supply chain disruptions, energy costs, etc. It cannot and should not be simply reduced to a monetary phenomenon, especially not by looking at something as one-dimensional as the M2 chart.

Lastly, the economy should be seen, as the post-Keynesians showed, as interlocking balance sheets. This is true simply through accounting identity — someone’s asset has to be someone else’s liability. Therefore, when we talk about paying back the debt or reducing government spending, the question should be what other balance sheets get affected and how. Let me give a simplified example: in the 1990s during the Clinton era, the U.S. government celebrated budget surpluses and paying back its national debt. However, since by definition someone else had to be getting more indebted, the U.S. household sector racked up more debt. And since households couldn’t create money while the government could, that increased the overall risk in the financial sector.

Bitcoin As Money

I can imagine the people reading till now (if you made it this far) saying “Bitcoin fixes this!” because it’s transparent, has a fixed issuance rate and a supply cap of 21 million. Here I have both economic and philosophic arguments as for why these features, regardless of the current state of fiat currency, are not the superior solution that they are described to be. The first thing to note here is that, as this piece has hopefully shown thus far, that since the rate of change of money supply is not equal to inflation, inflation under BTC is not transparent or programmatic and will still be subject to the forces of demand and supply, power of the price setters, exogenous shocks, etc.

Money is the grease that allows the cogs of the economy to churn without too much friction. It flows to sectors of the economy that require more of it, allows new avenues to develop and acts as a system that, ideally, irons out wrinkles. The Bitcoin standard argument rests on the neoclassical assumption that the government controls (or manipulates, as Bitcoiners call it) the money supply and that wrestling away this power would lead to some true form of a monetary system. However, our current financial system is largely run by a network of private actors that The State has little, arguably too little, control over, despite these actors benefitting from The State insuring deposits and acting as the lender of last resort. And yes, of course elite capture of The State makes the nexus between financial institutions and the government culpable for this mess.

But even if we take the Hayekian approach, which focuses on decentralizing control completely and harnessing the collective intelligence of society, countering the current system with these features of Bitcoin falls into the technocratic end of the spectrum because they are prescriptive and create rigidity. Should there be a cap on money supply? What is the appropriate issuance of new money? Should this hold in all situations agnostic of other socioeconomic conditions? Pretending that Satoshi somehow was able to answer all these questions across time and space, to the extent that no one should make any adjustments, seems remarkably technocratic for a community that is talking about the “people’s money” and freedom from the tyranny of experts.

Bitcoin is not democratic and not controlled by the people, despite it offering a low barrier to enter the financial system. Just because it is not centrally governed and the rules can’t be changed by a small minority does not, by definition, mean Bitcoin is some bottom-up form of money. It is not neutral money either because the choice to create a system that has a fixed supply is a subjective and political choice of what money should be, rather than some a priori superior quality. Some proponents might say that, if need be, Bitcoin can be changed through the action of the majority, but as soon as this door is opened, questions of politics, equality and justice flood back in, taking this conversation back to the start of history. This is not to say that these features are not valuable — indeed they are, as I argue later, but for other use-cases.

Therefore, my contentions thus far have been that:

- Understanding the money supply is complicated because of the financial complexity at play.

- The money supply does not necessarily lead to inflation.

- Governments do not control the money supply and that central bank money (reserves) are not the same thing as money.

- Inflationary currencies do not necessarily lead to a loss of purchasing power, and that that depends more on the socioeconomic setup.

- An endogenous, elastic money supply is necessary to adjust to economic changes.

- Bitcoin is not democratic money simply even though its governance is decentralized.

In Part 3, I discuss the history of money and its relationship with the state, analyze other conceptual arguments that underpin the Bitcoin Standard, provide a perspective on the Global South, and present alternative use-cases.

This is a guest post by Taimur Ahmad. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.