TLDR

- FDIC takes control of Metropolitan Capital Bank after its closure in 2026.

- First Independence Bank will acquire $251 million in assets from the failed bank.

- The FDIC expects a $19.7 million cost to its Deposit Insurance Fund.

- Customers can access funds immediately and continue loan payments after the closure.

???? Find the Next KnockoutStock!

Get live prices, charts, and KO Scores from KnockoutStocks.com, the data-driven platform ranking every stock by quality and breakout potential.

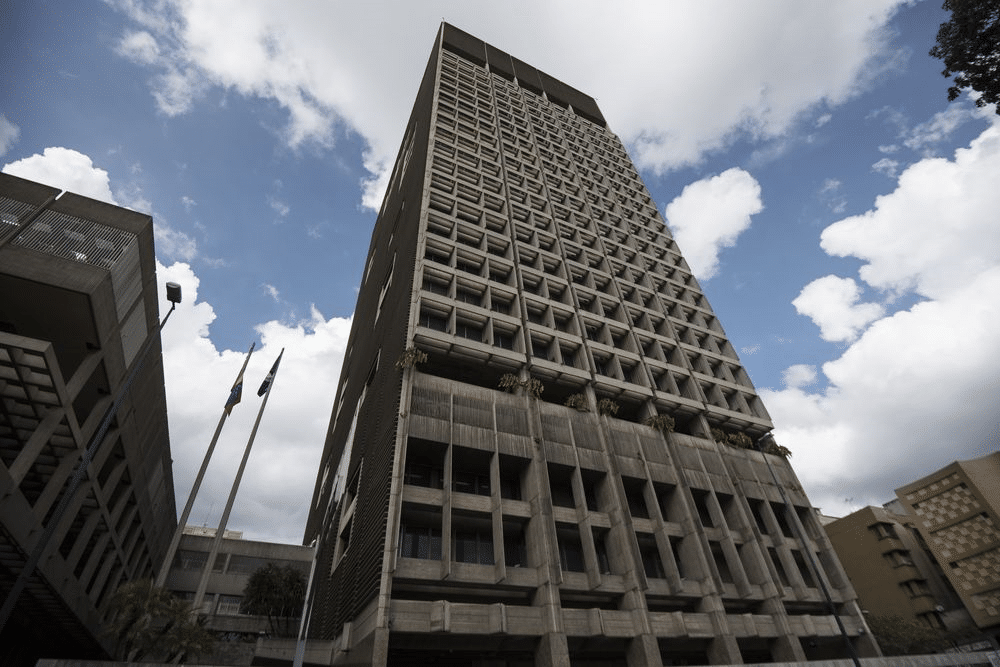

Metropolitan Capital Bank & Trust, a small, single-branch lender based in Chicago, has become the first U.S. bank failure of 2026. The bank was shut down by regulatory authorities on Friday, with the Federal Deposit Insurance Corp. (FDIC) appointed as receiver. The closure of Metropolitan Capital marks a significant event as it is the first such incident this year. This also comes after a period of relatively few bank failures in 2025.

????BREAKING: FIRST US BANK FAILURE OF 2026!

???????? Chicago’s Metropolitan Capital Bank & Trust CLOSED by Illinois regulators due to unsafe conditions and weak capital cited. pic.twitter.com/LnreyxGljv

— Ash Crypto (@AshCrypto) January 31, 2026

The failure of the bank is expected to cost the FDIC’s Deposit Insurance Fund approximately $19.7 million. The FDIC has announced that it will manage the remaining assets of the bank in order to resolve the situation. First Independence Bank has stepped in to take on most of the failed bank’s operations.

First Independence Bank Steps In to Acquire Deposits and Assets

In a move to provide stability, First Independence Bank has agreed to acquire about $251 million in assets from the failed Metropolitan Capital Bank. The bank has also assumed responsibility for nearly all of the failed institution’s deposits. This action ensures that customers’ funds are automatically protected by FDIC insurance.

Customers of Metropolitan Capital Bank will be able to access their funds immediately, using services such as checks, debit cards, and ATMs. They can also continue to make regular loan payments without disruption. The FDIC’s swift intervention ensures that banking services remain available to former Metropolitan Capital Bank customers.

FDIC Offers Full Coverage for Metropolitan Capital Bank’s Customers

After the closure of Metropolitan Capital Bank & Trust, the FDIC reassured customers that their deposits remain fully protected. FDIC insurance covers all accounts up to the insured limit. The FDIC emphasized that former Metropolitan Capital Bank customers could still access their funds without facing delays. Existing services, such as ATM access and online banking, will remain available.

As part of the arrangement, customers will also continue making loan payments through the same methods previously used. The FDIC ensures that there will be no disruption to customer accounts as the transition to First Independence Bank takes place. The closure of the bank has been managed smoothly to avoid major inconveniences for account holders.

The Reopening of the Former Metropolitan Capital Bank Branch

Starting February 2, the former Metropolitan Capital Bank location in Chicago will reopen under the branding of First Independence Bank. This change is part of the broader plan to integrate the failed bank’s operations into the acquiring institution. The FDIC’s handling of the situation ensures a seamless transition for both customers and the local community.

The transition is set to be completed swiftly, with minimal disruption to banking services. First Independence Bank is expected to maintain operations at the same location, allowing customers to visit the branch and conduct their banking activities as usual. The bank’s assets, deposits, and customers will be fully incorporated into First Independence Bank’s operations.

Kelvin Munene

Kelvin Munene is a crypto and finance journalist with over 5 years of experience in market analysis and expert commentary. He holds a Bachelor’s degree in Journalism and Actuarial Science from Mount Kenya University and is known for meticulous research in cryptocurrency, blockchain, and financial markets. His work has been featured in top publications including Coingape, Cryptobasic, MetaNews, Coinedition, and Analytics Insight. Kelvin specializes in uncovering emerging crypto trends and delivering data-driven analyses to help readers make informed decisions. Outside of work, he enjoys chess, traveling, and exploring new adventures.