Polkadot enables an internet where independent blockchains can communicate with each other in a secure, trust-free environment. Polkadot is the brainchild of Ethereum Co-founder Dr. Gavin Wood; it aims to achieve blockchain scalability through parachains, or parallel chains. These parachains are limited in number and can be “leased” for a finite amount of time. Parachains run in synchrony with the main relay chain and won’t get tied up with network slowdowns and high fees like Bitcoin or Ethereum have experienced in recent months.

Each parachain acts as a distinct blockchain “slot” in which a project can build into the Polkadot network. Since parachains are limited in quantity, decentralized applications (dApps) must compete and bid on each slot. Further, each slow can only be leased for two years until it is up for auction again. This parachain lease expiration date forces each dApp to remain competitive by proving its worth to the Polkadot framework.

If a project wins a slot, it can take advantage of Polkadot’s security, validation, and cross-chain interoperability features.

We’ll break this guide into three part to dive into the parachain leasing system works, the potential slew of Polkadot parachain companies, and how investors can take get involved:

- How Parachains Work

- The Parachain Auction System

- How You Can Invest in the Auction

How Parachains Work

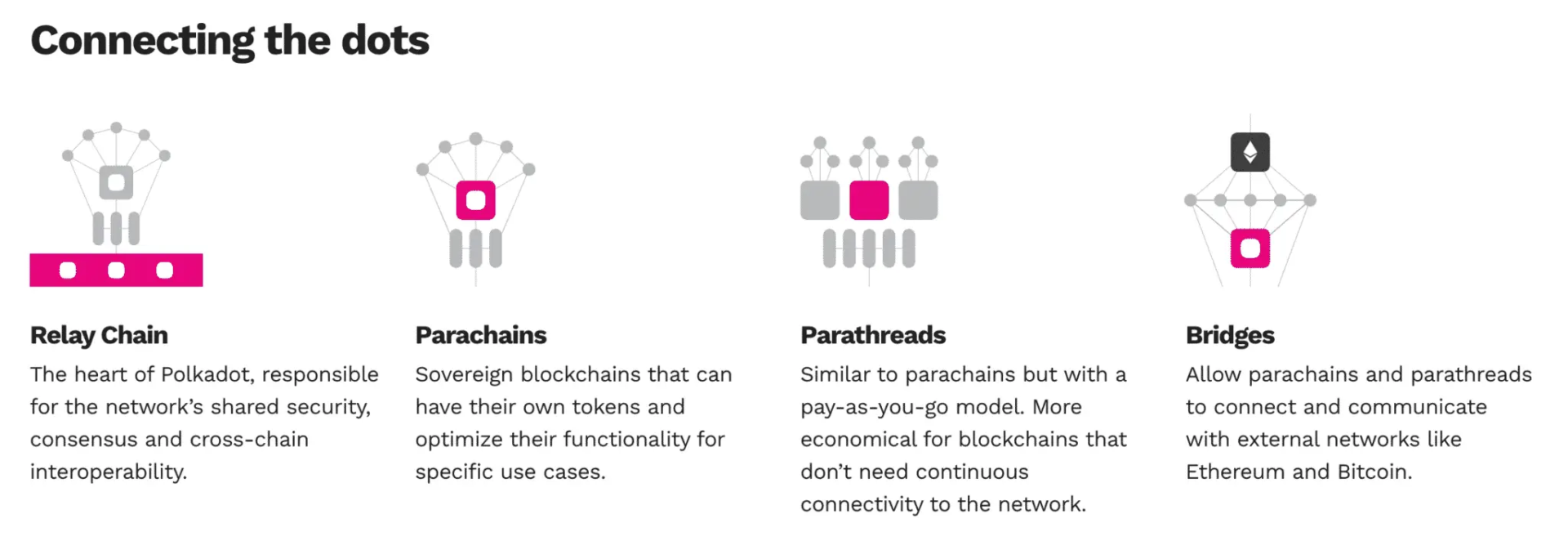

Parachains are the sought-after slots decentralized applications need to achieve scalability on the Polkadot framework. They run parallel to the relay chains, which allow them to share messages with other parachains on the network and leverage Polkadot’s security/validation network. This structure facilitates scalability through transaction processing alongside the relay chains.

Another way to think about parachains’ role on the Polkadot network is to compare them to applications on an iPhone. Apple provides the development language and infrastructure so companies can build out their application and take advantage of the network. This benefits Apple in terms of adoption and monetizing their ecosystem and benefits the companies by getting access to the ecosystem.

The major difference between Polkadot and Apple, however, is that Polkadot will more than likely only be releasing 100 parachain slots. This scarcity also increases the importance of each project’s role on the overall network. This is in stark contrast to Apple where any application with a developer and enough capital can gain access to the network.

So, how does the system work for securing one of these 100 slots? The following section will explore the importance of the Polkadot parachain auction system.

The Parachain Auction System

There is limited real estate on the Polkadot network for companies to secure parachain slots; let’s dive into how the auction system works to secure one of these slots.

Polkadot has chosen to use an auctioning system called the candle auction that is set to take place sometime in late 2021/early 2022. Taken from 17th-century ship auctions, the candle auction picks a random time during a set period to cease the auction and pick the highest bid at that specific point in time. This auction type was chosen because it limits the ability for people to “snipe” at the very end of the auction and it encourages the actual value of the bid to reveal itself early on.

Polkadot will be leasing out spaces in this auction for each parachain slot in increments of three months and companies can bid for up to two years (up to 8 individual slots per auction.)

Parachain contenders will have to bond their own DOT tokens or by using the crowdloan functionality, in which the company can encourage investors to send the company DOT tokens to strengthen their bid.

Once companies have their DOT ready to bond, they can put in bids for any one of the 3-month increments or for all 8 of the increments if they’re seeking a full 2 year lease period. This creates an incredibly competitive environment and gives DOT holders the ability to back projects that will strengthen the ecosystem.

On top of that, the length of the lease plays a huge factor in the successful projects securing future lease space and continually adding value to the overall Polkadot network. Acala Network is one such example of a project seeking to secure a parachain slot. They’re focused on becoming the DeFi Hub of Polkadot and already have a strong backing in the community.

Now that we understand how parachains and the auction system works, let’s dive into how one can take part as an investor.

How to Invest in Parachain Auctions

Like we discussed above, companies interested in securing a parachain slot can either front the DOT tokens themselves or make use of the crowdloan functionality. This is where individual investors can make their mark.

Once the parachain slots begin to open up, they’ll have the opportunity to unstake their DOT tokens and bond them to the project that is doing a crowdloan.

The good news is that if the project they’re backing doesn’t win the first auction, the team can enter another auction and will not have to continually keep giving the investors back their DOT investment.

There are a few benefits of contributing to a project:

- You’ll be directly contributing to that project’s chances of securing a spot.

- Projects may offer an incentive in the form of native tokens or DOT for your investment.

- After the lease period is over, you will get back your initial investment of DOT.

Yes, you technically aren’t “spending” your DOT to invest in a project. You’ll actually get your original DOT commitment back at the end of the project’s lease period, but you’ll get to keep the benefits accumulated during the same period.

The only disadvantage would be the interest you would forgo by staking your DOT, which is ~8-28% every year on platforms like Kraken or Binance.

If you truly believe in a project’s success, however, it may be worth it to miss out on some extra DOT.

If the project does not secure a spot, you will also receive your initial DOT investment back, as well.

If the project does secure a spot, however, it will be onboarded to the relay chain and your DOT will be locked in for the lease period.

Final Thoughts: How to Bid in Polkadot Parachain Auctions & Parachain Auction List

Many DOT proponents advocate for the growth of the Polkadot network as an evolution of web 3.0 and the new Internet. Polkadot’s test net, Kusama, is already kicking off its preliminary parachain auctions, and if you’re considering investing into anything in the Polkadot ecosystem or DOT, it’s worth familiarizing yourself with the Polkadot landscape.

Although Parachain auctions aren’t live yet, you can follow top projects on parachain.live.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.