SC Ventures, the investment division of Standard Chartered Bank, and SBI Holdings, the Japanese financial conglomerate, have joined forces to establish a $100 million cryptocurrency initiative in the United Arab Emirates.

The new vehicle, dubbed Digital Asset Joint Venture, will focus on companies involved in market infrastructure, risk and compliance, decentralized finance (DeFi), and tokenization.

The Digital Asset Joint Venture

According to the official press release, the Digital Asset Joint Venture plans to allocate funds across various investment stages, spanning from seed to Series C funding, with a primary emphasis on global investment opportunities.

This new vehicle is also expected to leverage SC Ventures’ experience in digital assets via its investments in fintech firms like Ripple and Metaco, according to SC Ventures’ CEP Alex Manson.

The exec also added that the Digital Asset Joint Venture plans to make strategic and minority investments in areas such as market infrastructure, risk management and compliance tools, DeFi, tokenization, consumer payments, and the Metaverse. This is one of several strategic initiatives, and we will continue to invest and expand our footprint in the region as well as across the digital assets ecosystem.

Confirming the development, Yoshitaka Kitao, SBI Holdings, Inc. Representative Director, Chairman, President and CEO,

“We are thrilled to announce our partnership to establish a Digital Asset Joint Venture in UAE together with SC Ventures and bring to bear the collective capabilities of both our organizations in the digital asset space. This initiative further solidifies the strategic relationship between SBI Holdings and SC Ventures following our investment forays into SC Ventures’ portfolio companies including Solv, Zodia Custody, and myZoi.”

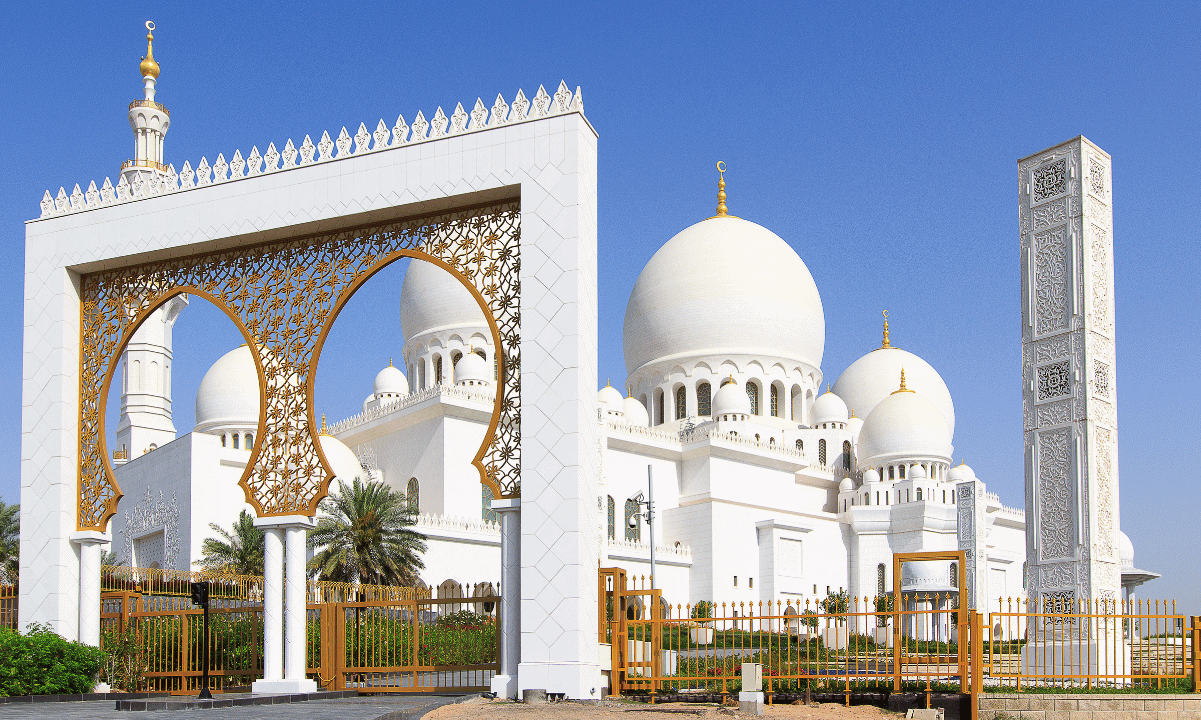

Standard Chartered’s UAE Inclinations

As US regulators grapple with the complexities of cryptocurrency regulations, major global banks have slowly geared up for the digital asset economy in more established jurisdictions.

Standard Chartered, for instance, chose Dubai as its focal point, aiming to start safeguarding its cryptocurrencies, such as Bitcoin and Ethereum, for institutional clients by the first quarter of 2024. The successful adoption by institutions necessitates the establishment of various essential components.

Aligning with its long-term goals, the British multinational bank entered into a memorandum of understanding with the Dubai International Financial Centre to work together in the industry with a particular focus on digital asset custody in May. During that same period, SC Ventures divested its ownership in Swiss-based Metaco.

Ripple, which is part of the SC Ventures portfolio, acquired the tech firm for $250 million.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).